The coronavirus comfort trade

Why the stock market is defaulting to what we all know worked in a prior life

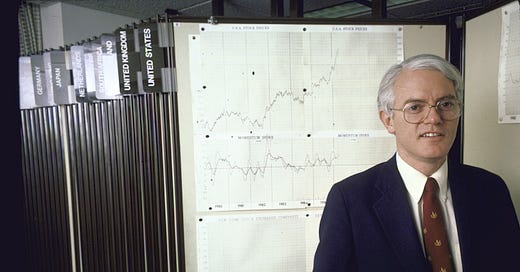

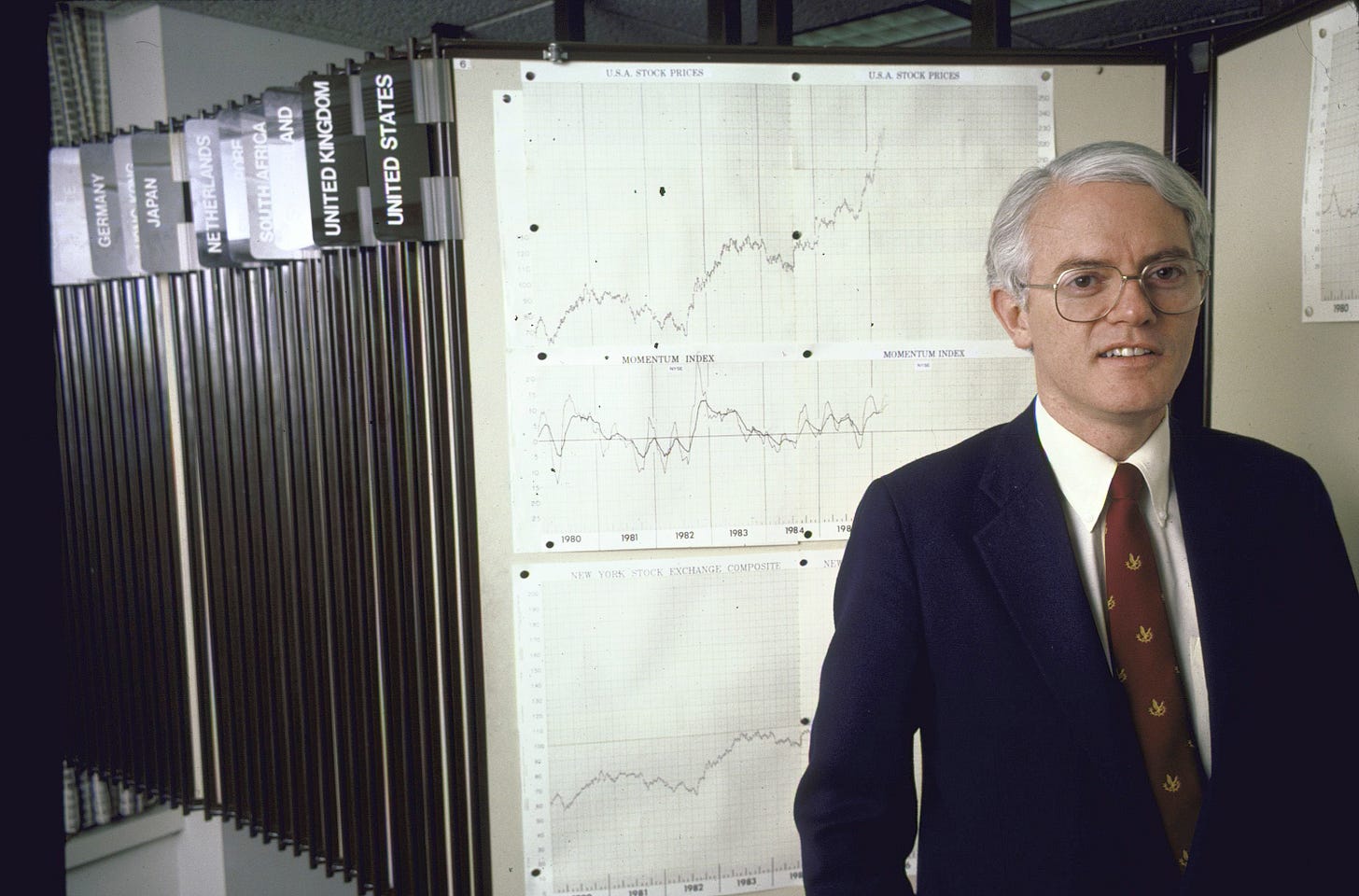

Legendary investor Peter Lynch is best known for the idea that investors should buy what they know.

If you wear Nikes and drink Starbucks coffee and wear lululemon to the gym and take Lyft rides to see your friends and mostly fly Delta, you’d have done okay in the market over the last few years.

Of course, this idea becomes oversimplified, bastardized, and warped to the point of meaninglessness through the years. Ideas and maxims tend to get run through a game of intellectual telephone that goes as poorly as any grade school version of the exercise.

But as we take stock of where things stand in markets right now, there are signs of investors expressing a Lynchian tendency to find comfort in what can be understood in a moment where genuinely no one knows anything.

And what “the market” broadly understands is that when the Federal Reserve is offering support, stocks go up. In the last few years, this has meant big cap tech stocks — Apple, Microsoft, Amazon, Alphabet — go up even more. Since the March 23 bottom, the S&P 500 has risen 28.5% and the Nasdaq Composite is up 27.9%. Over the last year, the S&P 500 is now off just 1% and the Nasdaq is up 8%.

We could debate why this happens, whether this is really true, if the market is getting this one wrong, if the Fed is nationalizing markets, if this really is investor socialism, and so on. But these are tired conversations and debates you can have at any minute of the day on a Twitter feed near you.

What does seem clear to me is the observed reality that an easier Fed means higher stock prices. And what’s happening in the market right now simply means these conditions hold over a wider range of scenarios than was previously expected.

But this reaction in one narrow part of a world trying to collectively cope with the stress of coronavirus is another example of why nostalgia is our most potent remedy right now.

In his March 22 newsletter, Eugeue Wei wrote:

Just as investors everywhere have been fleeing to capital liquidity, the emotional calculus of relationships changes when your time horizon shifts. I’ve written about the circadian rhythms of tech before, but in long stretches of quarantine, one can’t help but reassess the allocation of one’s emotional portfolio. The older you get, the more they tell you to shift from equities to less volatile assets. In a pandemic, one gravitates towards the familiar. Shares in nostalgia are trading higher.

Before reading Eugene’s piece I’d found myself thinking a lot about running cross country in high school. These are some of the best memories of my life. I stared out my window in late March trying to calm myself down and thought about those years, listening to the music that I had on repeat in the early- and mid-00s. I turned the noise cancelling on and the volume way up. I wanted to stop seeing or hearing or feeling what was right in front of me and pretend it was a fall day in 2006.

Connecting with anything — a television show, a song, a blog post, a novel — requires the right mindset from the viewer, listener, reader. And not just being alert or focused, but being adequately vulnerable so that you can maximally connect with that piece of art. I think about the books and shows and movies that I remember as most formative to me and it often seems sort of silly to think it was really that piece of art and not the fact that I was 21 or 22 or 23 that created the impression.

I’m sure I’d enjoy A Visit From The Goon Squad or Skippy Dies if I re-read them today, but I only cried because I was a lonely college student in 2011. And I only want to think about running in high school right now because I’m sitting inside during a global pandemic. Our compromised state makes the past more real than our present. One day those memories will be locked away once again.

But it wasn’t until I read Eugene’s piece that any of this made sense to me.

By now, of course, I think we have a broader cultural grasp on our collective nostalgia trade. HBO GO has a “comfort viewing” section on the app. The shares Eugene bought in late-March have appreciated considerably over the last month.

The challenge now is trying to find something familiar in a world where everything is new, a world in which the reality of right now makes itself felt across time and space and platforms. You can’t mine your memories indefinitely.

And yet we can’t open Twitter without seeing some horribly pessimistic article from The Atlantic reminding us that not only will we not live a normal life in 2020, or 2021, or 2022, or 2023, but that our lives will never be good again.

We can’t watch television anymore: the commercials have become self aware.

Sports don’t exist. There will be no new movies for another year at least. Cable news is the same. And so on.

The most effective way to occupy our overstimulated and confused minds right now is to think about the past, about life challenges that are already solved. As individuals, this means daydreaming about some glory day gone by. For investors, this has meant buying big cap tech stocks.

Explaining why the stock market does anything is always a fraught endeavor. I’ve written far too many posts in the last several years about why thinking too hard about any one day’s market action will, over time, melt your brain. Chasing your tail doesn’t quite capture the futility of this endeavor.

And I don’t think positing that the market is trading higher now because investors are nostalgic for a time when easy Fed policy = higher stock prices is really offering a good answer. It’s a back-fitted “this is what I’m feeling so maybe others are feeling it too” explanation for something that cannot be cogently explained with any credibility.

But it’s the best I think any of us can really do right now.

Whether we’re explaining the stock market or anything else.

Thanks for reading I’m Late to This. If someone sent this your way or you haven’t do so yet sign up below so you never miss an issue. We publish every Sunday morning.

If you agree, disagree, or just want to engage on any of the topics discussed in this letter reply to this email or hit me up on Twitter @MylesUdland.

Feedback is always welcome and highly encouraged.