Bitcoin is a thing that exists

You don't have to care about Bitcoin, but it's time for everyone to accept that Bitcoin isn't going anywhere.

Hello and welcome to the slightly rebranded newsletter — I’m Late to This is now Late by Myles Udland.

The original name was made up with basically no thought put into it. This project grew out of conversations I had with people about the newsletter space in 2019 and the feedback I kept getting was, “Just start one and see what happens.”

And this is what happened.

More than 2,000 people now receive Late each Sunday, a number we hope to continue growing in the year ahead. Late is free to read and plans to remain that way indefinitely.

If someone sent this newsletter your way or you found it through Twitter or other channels, make sure to sign up below so you never miss an issue.

And now, Bitcoin.

You cannot not have an opinion on Bitcoin.

I mean, you can.

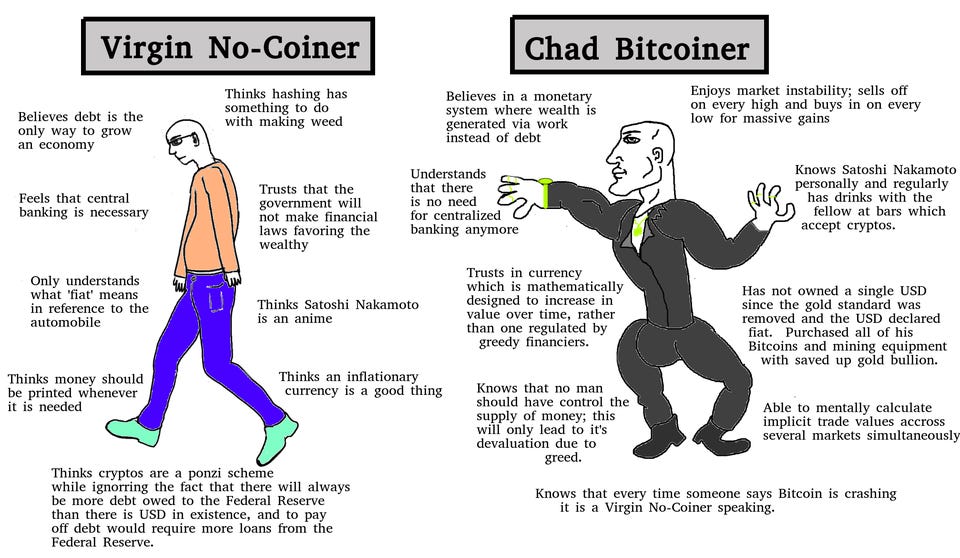

But the rules of Bitcoin discourse are basically the rules of internet message board discourse.

And these rules state that having “not an opinion” on something is indeed an opinion. And, further, that this no opinion view is a negative opinion on the thing about which one holds “no view.”

And we know what that means.

So back 2017, when the price of Bitcoin mooned and the majority of people in financial markets were paying attention to the crypto space for the first time, the plurality judgement from Wall Street was that the best use for Bitcoin and other coins was fraud. The logic follows, then, that if these things are only good for fraud and the price is going up, then there must be a fraudulent reason for the price to be rising this way.

And fraud or no fraud — and indeed, there was some fraud! — there was a bubble in crypto assets in 2017. The rise of dentacoin and dogecoin are the two I like flagging as clear signs that what was happening in 2017 was pretty dumb. Long Island Iced Tea rebranding as Long Blockchain happened three years ago tomorrow, another canonical moment of the 2017 frenzy. We talk a lot now about SPACs, but let us not forget that this decade’s innovation in how one raises money accelerated with the ICO boom.

So through 2018, the price of just about everything in the coin space came down a lot, the fraud was weeded out, and now three years later we are talking about a real thing.

Another line that got worked over plenty in 2017 and 2018 was the idea that Serious Investors were “not that interested in Bitcoin, but excited about blockchain.” IBM started running blockchain commercials during the 2018 football season.

And, sure, there are plenty of blockchain projects happening right now. But the crypto story today is about price, and specifically, the price of Bitcoin.[1] And because Bitcoin is now a necessary part of painting any complete picture of financial markets, we can now offer it the highest praise possible — Bitcoin is a thing that exists.

Back in November, Bloomberg’s Tracy Alloway said she was flipping from a Bitcoin skeptic to a Bitcoin believer.

The list of Bitcoin's purported uses goes on and on, and every time an obituary for Bitcoin is written, a new use case or bull argument steps in to take its place. I used to think this was a weakness since Bitcoin could never be all these things at once. But the more I think about it, the more I realize it's actually a strength.

Bitcoin is a thing on which people can project their hopes and dreams — whether it's for a fairer society, a more inclusive financial system, or simply more money. Since hopes and dreams are endless, there will always be a fresh bull case for Bitcoin waiting in the wings.

In that sense, it's really the perfect post-modern financial asset for a post-modern financialized economy.

This is a more articulate and well-argued version of what I said on Twitter this week — the more the story of Bitcoin is about price, the stronger the story.

But the conditions that Tracy outlines for Bitcoin’s relevance also hold true for every asset investors follow regularly. The level of the S&P 500, the yield on the U.S. 10-year, the price of oil, the price of any stock, and so on, are all subject to similar projections from investors, speculators, lawmakers, and the public.

So when we’re hung up on regulating Bitcoin, or on how people are or are not using Bitcoin, when we’re talking about the market getting pushed around by whales, or Coinbase’s limitations, or whether the halving was priced in (it was), we’re just distracting from what makes Bitcoin specifically relevant. And that is the price of one Bitcoin.

I don’t know who first introduced the frame, but my preferred way to think about Bitcoin is that it’s either worth $0 or $1,000,000. Any other price is the wrong price. I remember in 2012, Barron’s wrote a cover story that said Facebook shares were going to $15. The price at the time was around $20ish. Someone I worked with who owned a lot of Facebook shares didn’t like this story because they said the stock was either worth $5 or $100, but that $15 or $20 was definitely not the right price. On Friday, Facebook shares closed at $276. I wonder if he sold.

So if the contention of my post is that Bitcoin is real, that we’re never going to live in a future financial moment where the price of Bitcoin isn’t relevant, and that the “right” price for Bitcoin is either $0 or $1,000,000, then at ~$24,000 Bitcoin is a screaming buy. Because while your downside is, of course, 100%, the upside from $24,000 to $1,000,000 is closer to 4,100%. Sadly for me, I own no Bitcoin right now.

This idea that Bitcoin is a bet on a binary outcome of $0 or $1,000,000 also offers a continuum along which we can think about the asset’s relevance. For every dollar that Bitcoin rises closer to $1,000,000, the more solidified its standing in financial markets becomes. The scale, however, is not linear.

Bitcoin at $20,000 is more than twice as important as Bitcoin at $10,000. And I’m sure that at $40,000 the importance of Bitcoin — the paper wealth it creates, the interest Wall Street is going to have from its clients, the number of profiles Bloomberg will write about HODLers who don’t have to work anymore, etc. — will be more than double the import Bitcoin has today. We can only dream of what the world will look like when Bitcoin does indeed get to $1,000,000.

There are questions, of course, about why Bitcoin is trading where it is today.

Someone replied to me this week and said they love “slow database tech” and also love money that can be any price tomorrow. I really don’t know anything about the actual Bitcoin blockchain but maybe it’s slow? I honestly don’t care. And, yes, sure. “Bitcoin is money” is complicated and we thank Elon Musk for his contribution to the discourse earlier today.

But this is a little bit like the “From Android” critique of Apple, a critique which says Apple’s tech has inferior specs and is overpriced “because of the brand.” I’m not sure whether 1: this was ever all that true, 2: is true anymore, or 3: is something tech enthusiasts (you know, the kind who build their own gaming rigs, etc.) still say. But this view was pretty much the opposite of anything that would’ve been useful for investors and it holds here for Bitcoin: no one cares if the network is good or the price is volatile. The strongest case for owning Bitcoin is that pretty much everyone has heard of it and has an opinion on whether you should own it.

A lot of the “why” regarding Bitcoin trading at ~$24,000 right now can also be understood through the same dynamics that have been driving the IPO market this year. Airbnb and DoorDash shares went up so much on their first day of trading not because there was a banker-led conspiracy to “steal” money from the companies. These stocks went up on the first day because a tiny fraction of the total shares outstanding were made available to trade and lots of people were interested because they’ve stayed in Airbnbs and ordered food on DoorDash. Scarcity, in other words, is driving the price.

And scarcity is something Bitcoiners are familiar with. The total number of Bitcoin outstanding will grow over time until we get to 21 million. But how many coins exist today or will exist in the future doesn’t tell us anything about how many coins — or fractions of coins — will be available for purchase in the open market at any one time. Today, clearly, there are fewer coins being offered for sale than demanded for purchase.

So when the price of Bitcoin rises a lot we are left with two basic impulses impacting future prices. Either more HODLing happens because the paper wealth generated by owning, say, two Bitcoins keeps growing or less HODLing happens because more people want to realize the gains from these two Bitcoins.

As we can see in Tracy’s outline above, however, there is no “right” reason for buying or selling or HODLing your coins, so either preference becoming the majority opinion of investors is just as likely at any point in time. All we can see, then, is what the price does and back into reasons from there. This is also why technical analysts love Bitcoin: there is literally no fundamental case.

So today, there is more HODLing than selling and this restricted supply supports higher prices. If our price target is $1,000,000, any price moves between here and there are worth HODLing through. The only relevant question would be when do you buy more.

We also see the non-linearity of Bitcoin’s ascent from $0 to $1,000,000 in how Wall Street talks about it. This week, Scott Minerd, the global CIO at Guggenheim, told Bloomberg Bitcoin should be worth $400,000.

“Our fundamental work shows that Bitcoin should be worth about $400,000… It’s based on the scarcity and relative valuation such as things like gold as a percentage of GDP. So you know, Bitcoin actually has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions.”

And, sure. I’d love to see the work but also I don’t really need to. No one does.

Because Minerd here is shifting something like the Overton Window for Serious Investors and telling not only his clients but his peers on Wall Street that it’s okay to come out and say something super-bullish on Bitcoin. No one is going to get shamed or laughed out of their high-powered strategist post for opining on Bitcoin’s future in a positive way. Tom Lee might’ve been lonely on his crypto island over the last few years, but reservations to join him are filling up quickly.

The most basic sentiment analysis will tell you that a generalist like me writing about Bitcoin marks the top. It’s like the digital version of the “magazine indicator” or whatever. But in a world where the knowledge of the crowd trends increasingly towards everyone knowing everything, I don’t find this framework all that compelling.

It is far more fruitful to ask — whether about Bitcoin or any other asset — not why the price is so high but why the price is so low. The investing legends of the 20th century became famous for writing about margins of safety and cigar butts and what would be left for shareholders if you liquidated the company and distributed the leftover cash. And maybe the investing legends of the 21st century will find success by these same methods.

But the central thesis of this 20th century vision of investing basically argues that you consider risks the crowd hasn’t yet priced in and profit off this spread. Which is more compelling when getting a company’s earnings report faxed to your office counts as proprietary information. But the risks and shortcomings and pitfalls of Bitcoin or any other financial asset today aren’t exactly under discussed.

The question, then, might not be when Bitcoin will get to $1,000,000, but rather why it hasn’t already.

1: Though the tweets this week from people getting random texts about ether really picked up.